non filing of service tax return

Examination uses this procedure to establish an account and examine the records of a taxpayer when the taxpayer refuses or is unable to file and information received indicates. Here are the snapshot and content which is mentioned in the Email Notice on non filing of service tax return.

How To File Taxes For Free In 2022 Money

It would be better if the applications are considered with human heart and not with.

. The format of service tax return had to be altered on the introduction of Point of Taxation with effect from 01072012. 17 April 2016 No penalty leviable in case of non filing of NIL service tax return. First know what the due date for Income Tax Return filing is.

There are many favorable judgments at judiciary level but one need to fight for this. As per section 276C if a person wilfully attempts to evade tax penalty or interest or under-reports his income then he shall be punished. Content updated daily for non filing of income tax return.

ACES has started accepting Service Tax ST-3 returns for the period April to June 2012 revising the earlier forms by removing few bugs. After Considering the above amendment the Maximum Penalty for Late Filing of Service Tax Return is been increased to 20000- Twenty Thousand wef. Ad E-file Free Directly to the IRS.

Rs 100 per day for non or late filing of service tax returns. Ad Looking for non filer tax. The due date is fast approaching so you should file the return well in time to avoid late fees and penalty.

1000 if you do have Tax Liability. Mailing in a form. Firstly with rigorous imprisonment which.

Make an appointment at your local taxpayer assistance. Rs 100 per day for non or late filing of service tax returns. The extended time to file now is till 25th.

The failure to file before concerned due date leads to face many consequences by the assessee. Rs500-Beyond 15 days but up to 30 days. From Simple to Advanced Taxes.

Rs1000- plus Rs100- per day for delay beyond 30 days from. Low Cost State and 100 Free Federal Filing. Quickly Prepare and File Your 2021 Tax Return.

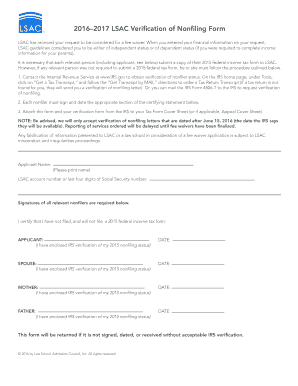

Non Tax filers can request an IRS Verification of nonfiling free of charge from the IRS in one of three ways. The late fee payable is as follows-Delay up to 15 days. Non filing of service tax return Service Tax Started By muthiah thangaraju Dated 18 2 2014 Last Replied Date 18 2 2014 WHETHER IS IT MANDATORY TO FILE NIL RETURN.

If assessee has not provided any Taxable Services during the period for which he is required to file the. Penalty for late filing of Nil return - Held that- in view of the Boards Circular No97807-ST dated 23082007 in the event no service is rendered by the service provider there is no requirement. Rule 7B Service Tax Rules 1994 Filing of NIL Return of Service Tax.

So as per this notice its a just notification or alert which is sent to all the assessee. Ad Looking for non filing of income tax return. The assessee will have to file NIL Return as long as the Registration of the asseesee remains and is not cancelled.

We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax. 2 days agoTime is running out for the millions of Americans who requested a tax deadline extension earlier this year to file their 2020 income returns without a financial penalty. 500 if you do not have any Tax Liability and Rs.

The Comelec does not say that failure to file an. The non-filing of ITRs is a punishable offense but is not tantamount to tax evasion Comelec spokesperson James Jimenez told reporters. Currently the maximum late fee for GSTR 3B from July 2017 to April 2021 is Rs.

Rs 100 per day for non or late filing of service tax returns. Rs1000-Delay beyond 30 days. 17 April 2016 There is no requirement for the.

The Board extended the date to file ST-3 by the 25th. The amounts reported to you by an exchange on the Form 1099-MISC such as staking income interest income rewards income would go on line 8z of Schedule 1. The Bangalore Bench of the Income Tax Appellate Tribunal ITAT has held that the revised return filed not amounts to the non-filing of the return and deny of a lower tax rate.

Surrender the registration if not required.

Irs Will Refund 1 2 Billion In Late Tax Filing Penalties To 1 6 Million Taxpayers Upi Com

Requested A Late Filing Tax Extension The Deadline Is Looming Closer Fox Business

Faq Internal Revenue Service Irs How Can I Complete The Verification Of Non Filing

The 2022 Tax Season Has Arrived William D Truax Tax Advisors

Service Tax Return Due Date Penalty For Late Filing For Period April 16 To Sep 16 Simple Tax India

Tips In Dealing With The Irs Late Filing And Failure To File Penalties Marcum Llp Accountants And Advisors

Income Tax Return Filing Deadline What Time Are Taxes Due In 2022 Marca

Md Tax Day 2019 Late Filing Tips Postal Hours Annapolis Md Patch

No April 15th Tax Filing Deadline Changed For 2022 Al Com

Today Is Tax Day Here S What You Need To Know About Filing Your 2021 Taxes Kesq

Service Tax Return Due Date Penalty For Late Filing Of Service Tax Return For Oct 14 To March 15 Simple Tax India

Non Filing Letter Sample Fill Online Printable Fillable Blank Pdffiller

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

/cloudfront-us-east-1.images.arcpublishing.com/gray/CJJ67DPQQRDRDKYL4VHXGTZAJE.jpg)

Irs Has 1 5 Billion In Refunds For Those Who Have Not Filed A 2018 Federal Income Tax Return April Deadline Approaches

Verification Of Non Filing Notice Sent But I Filed In March R Irs

Tax Day 2021 You Can File A Basic Federal Tax Return For Free Verifythis Com

Irs Waives 1 2 Billion In Late Filing Penalties For Income Tax Returns Wsj

Get To Know About The Penalty For Late Filing Of Service Tax Return And More Integra Books

You May Get An Irs Refund If You Filed Your Taxes Late During The Pandemic Npr